Are you feeling overwhelmed by the complexities of Medicare? Choosing the right plan can feel like navigating a maze, but it doesn't have to be. This article aims to shed light on the Humana Gold Plus Medicare Advantage plan, a popular choice for many seniors seeking comprehensive healthcare coverage. We'll delve into the details, exploring its benefits, costs, and what makes it stand out from the crowd.

Medicare Advantage plans, often referred to as Part C, are offered by private insurance companies like Humana, contracted with Medicare to provide coverage. These plans typically bundle Part A (hospital insurance) and Part B (medical insurance) benefits, and often include prescription drug coverage (Part D). The Humana Gold Plus plan falls under this umbrella, offering various options tailored to different needs and budgets.

Humana has a long history of providing health insurance, evolving alongside the changing landscape of healthcare. The company's Medicare Advantage offerings, including the Gold Plus plan, have emerged as a response to the growing demand for more comprehensive and flexible Medicare coverage. The importance of these plans lies in their ability to streamline healthcare access, providing a single point of contact for various medical services, often with added benefits not found in Original Medicare.

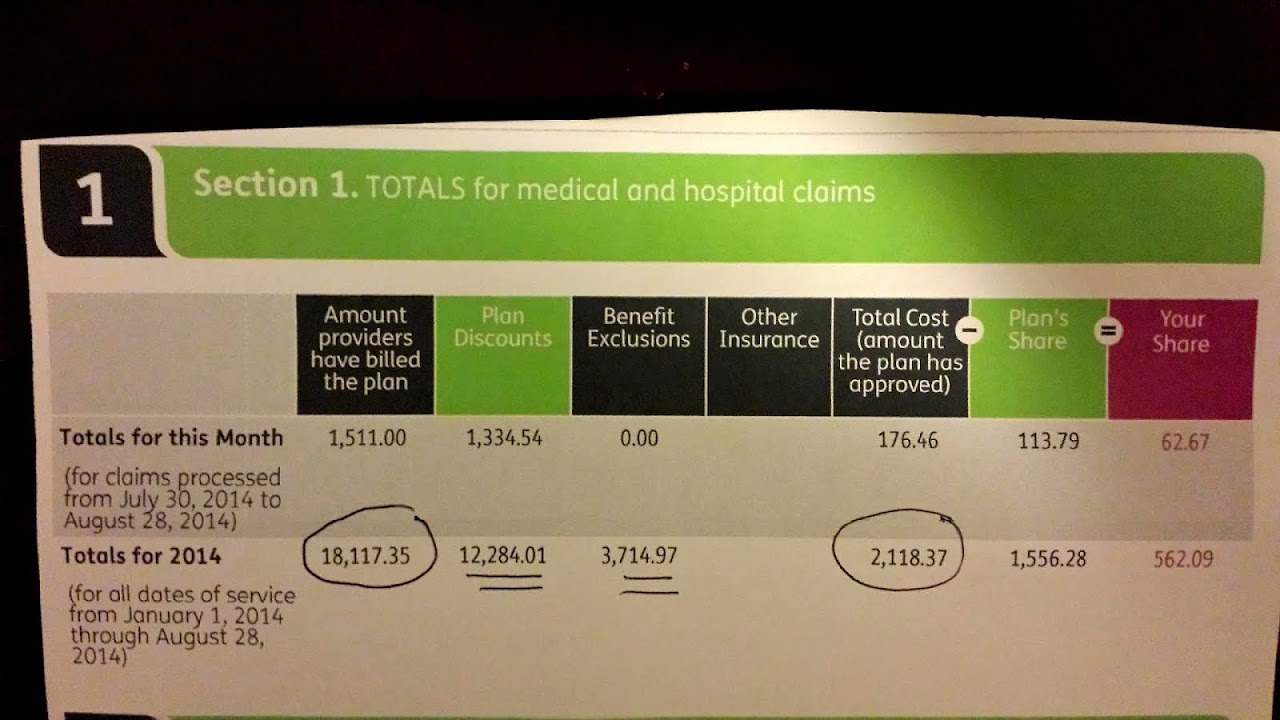

A common concern among those exploring Medicare Advantage plans like the Humana Gold Plus plan relates to network limitations. Understanding how these limitations may affect access to specific doctors and hospitals is crucial. Additionally, out-of-pocket costs, including premiums, deductibles, and co-pays, can vary significantly between plans, requiring careful consideration.

The term "Humana Gold Plus Plan" encompasses a range of plans under the Humana umbrella, each with varying levels of coverage and benefits. It's essential to carefully review the specifics of each plan to understand what's included and excluded. For example, some Gold Plus plans may offer enhanced dental or vision coverage, while others might focus on providing lower prescription drug costs. Comparing these options is key to finding the best fit for your individual needs.

One of the benefits of a Humana Gold Plus Plan is the potential for lower out-of-pocket costs compared to Original Medicare. Some plans offer $0 premiums, reducing monthly expenses. Another advantage can be the inclusion of extra benefits, like dental, vision, or hearing coverage, not typically covered by Original Medicare. Lastly, many Humana Gold Plus plans offer prescription drug coverage, simplifying medication management and potentially lowering drug costs.

Choosing the right Medicare plan involves several steps. First, assess your healthcare needs and priorities. Then, research different plans, comparing coverage and costs. Finally, enroll in the plan that best aligns with your requirements.

Advantages and Disadvantages of Humana Gold Plus Plan

| Advantages | Disadvantages |

|---|---|

| Potential for lower out-of-pocket costs | Network limitations |

| Extra benefits like dental and vision | Plan complexity |

| Prescription drug coverage | Varying costs between plans |

Frequently Asked Questions:

1. What is the difference between Humana Gold Plus and Original Medicare? - Humana Gold Plus is a Medicare Advantage plan offered by a private insurer, while Original Medicare is administered by the government.

2. Does Humana Gold Plus cover prescription drugs? - Many Humana Gold Plus plans include prescription drug coverage.

3. How do I enroll in a Humana Gold Plus Plan? - You can enroll online, by phone, or through a licensed insurance agent.

4. Are there network restrictions with Humana Gold Plus? - Yes, most Humana Gold Plus plans have provider networks.

5. What are the costs associated with a Humana Gold Plus plan? - Costs vary depending on the specific plan and may include premiums, deductibles, and copays.

6. Can I change my Humana Gold Plus plan? - Yes, you can change your plan during certain enrollment periods.

7. Does Humana Gold Plus cover vision and dental? - Some Humana Gold Plus plans offer vision and dental coverage.

8. How do I find a doctor in the Humana Gold Plus network? - You can use Humana's online provider finder tool.

In conclusion, navigating the Medicare landscape can be challenging. The Humana Gold Plus plan, with its various options and potential benefits, offers a valuable alternative to Original Medicare. Understanding the nuances of each plan within the Gold Plus umbrella, carefully weighing the pros and cons, and aligning your choice with your individual needs is essential for making an informed decision. By actively researching and comparing plans, you can empower yourself to take control of your healthcare and find the best coverage for your golden years. Remember to compare plans carefully and consider consulting with a licensed insurance agent for personalized guidance.

Unlocking the mystery of playstation store ea fc 25

Elevate your kia soul the art of curated components

The zest of italy alcohol free exploring non alcoholic limoncello

/https://i2.wp.com/chiaki.vn/upload/seller/1658192835-gold-plus-1-400g--truoc-.png)