In today's interconnected world, the need to send money across borders has become increasingly common. Whether supporting family abroad, paying for international services, or managing overseas investments, a reliable and efficient money transfer service is essential. Western Union has long been a prominent player in this field, offering a way to move funds quickly and internationally. But what exactly is involved in a Western Union money transfer, and what factors should you consider when choosing this method?

Western Union provides a platform for sending and receiving money globally. With a vast network of agent locations and online services, it facilitates transfers to numerous countries and territories. Understanding the specifics of using this service, including fees, transfer speeds, and security measures, is crucial for making informed decisions about your financial transactions.

This comprehensive guide aims to delve into the world of Western Union money transfers. We'll explore the history and evolution of the company, the various services they offer, and the advantages and disadvantages of choosing this method. From understanding the fees involved to navigating the process of sending and receiving money, this guide will equip you with the knowledge you need to utilize Western Union effectively.

The history of Western Union is deeply intertwined with the development of telecommunication. Originally founded as a telegraph company in 1851, the company recognized the opportunity to leverage its network for financial transactions. In 1871, it launched its money transfer service, revolutionizing how people sent and received funds. This early adoption of financial services cemented Western Union's position as a pioneer in the industry, paving the way for the global money transfer landscape we know today.

Over the years, Western Union has adapted to changing technologies and customer needs. From its initial reliance on telegraph lines to embracing digital platforms and mobile applications, the company has continually evolved to remain relevant in the ever-changing financial world. Understanding the history and evolution of Western Union provides valuable context for appreciating its current role in facilitating international money transfers.

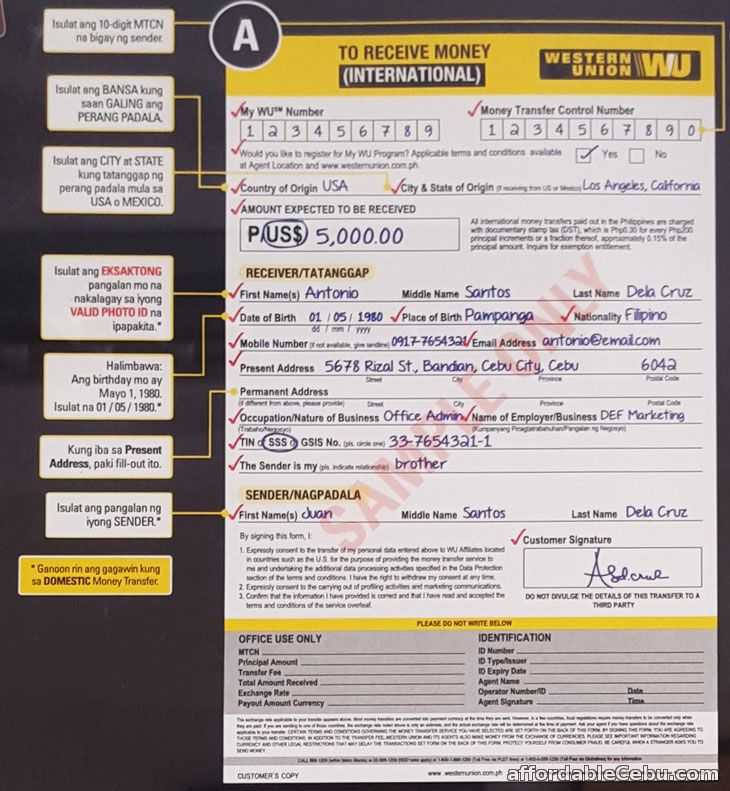

Western Union allows you to transfer funds to recipients in various ways, including directly to a bank account, for cash pickup at an agent location, or even to a mobile wallet in certain regions. This flexibility makes it a versatile option for diverse financial needs. One example is sending money to a family member who needs cash quickly for an emergency. They can pick up the funds at a nearby agent location shortly after the transfer is initiated. Another example is paying for an online course from an international institution. You can transfer the funds directly to the institution's bank account.

One benefit is Speed. Western Union transfers can be completed very quickly, sometimes within minutes, depending on the chosen service and destination. Another benefit is Accessibility. With a vast global network of agent locations, Western Union offers convenient access for sending and receiving money in numerous countries and territories. Global Reach is another benefit. Western Union facilitates money transfers to over 200 countries and territories, making it a truly global solution for sending and receiving money.

Advantages and Disadvantages of Western Union Money Transfers

| Advantages | Disadvantages |

|---|---|

| Speed | Cost |

| Global Reach | Exchange Rates |

| Accessibility | Security Concerns |

Frequently Asked Questions

Q: How much does a Western Union transfer cost? A: The cost varies depending on the amount sent, the destination, and the transfer method.

Q: How long does a transfer take? A: Transfers can be completed within minutes or take several business days, depending on the chosen service.

Q: What information do I need to send money? A: Typically, you'll need the recipient's name, location, and sometimes bank account details.

Q: How can I track my transfer? A: You can track your transfer online using the Western Union website or mobile app.

Q: What are the payment options for sending money? A: You can typically pay with a debit card, credit card, or bank transfer.

Q: Is Western Union safe? A: Western Union implements security measures to protect transactions, but it's important to be aware of potential fraud risks.

Q: What should I do if I encounter a problem with my transfer? A: Contact Western Union customer support for assistance.

Q: Can I cancel a Western Union transfer? A: In some cases, you may be able to cancel a transfer, depending on its status.

Tips and Tricks for Using Western Union: Compare fees and exchange rates before sending money. Use the online tracking tool to monitor your transfer. Keep your transaction details secure.

In conclusion, Western Union remains a significant player in the international money transfer arena. Its extensive network, range of services, and speed make it a practical option for many. However, understanding the fees, exchange rates, and potential security concerns is crucial for making informed decisions. By weighing the advantages and disadvantages and following the best practices outlined, you can utilize Western Union effectively for your global money transfer needs. Whether supporting loved ones overseas or conducting international business transactions, choosing the right money transfer service is essential. With careful consideration and a thorough understanding of the process, you can navigate the world of international money transfers with confidence.

Ea sports fc 24 on xbox one the ultimate guide

Decoding the tiktok icon aesthetic

Crafting worlds a look inside video game design companies