Navigating the world of personal finance can feel like walking a tightrope. One aspect that often raises questions is understanding the limitations of our financial tools, such as checks. This exploration delves into the practicalities surrounding Wells Fargo check limits, offering insights to help you manage your finances with greater clarity and ease.

While there isn't a universally defined "maximum" number of Wells Fargo checks you can write, several factors influence how many checks you can realistically use. These factors include your account type, available balance, and individual transaction limits that might be in place. Understanding these nuances can empower you to make informed decisions about your checking account usage.

The history of checks is intertwined with the evolution of banking itself. Originally, checks served as a more secure alternative to carrying large sums of cash. Over time, they became a cornerstone of personal and business finance. Today, while digital transactions are increasingly prevalent, checks remain a relevant tool for specific situations, highlighting the importance of understanding their usage within the Wells Fargo system.

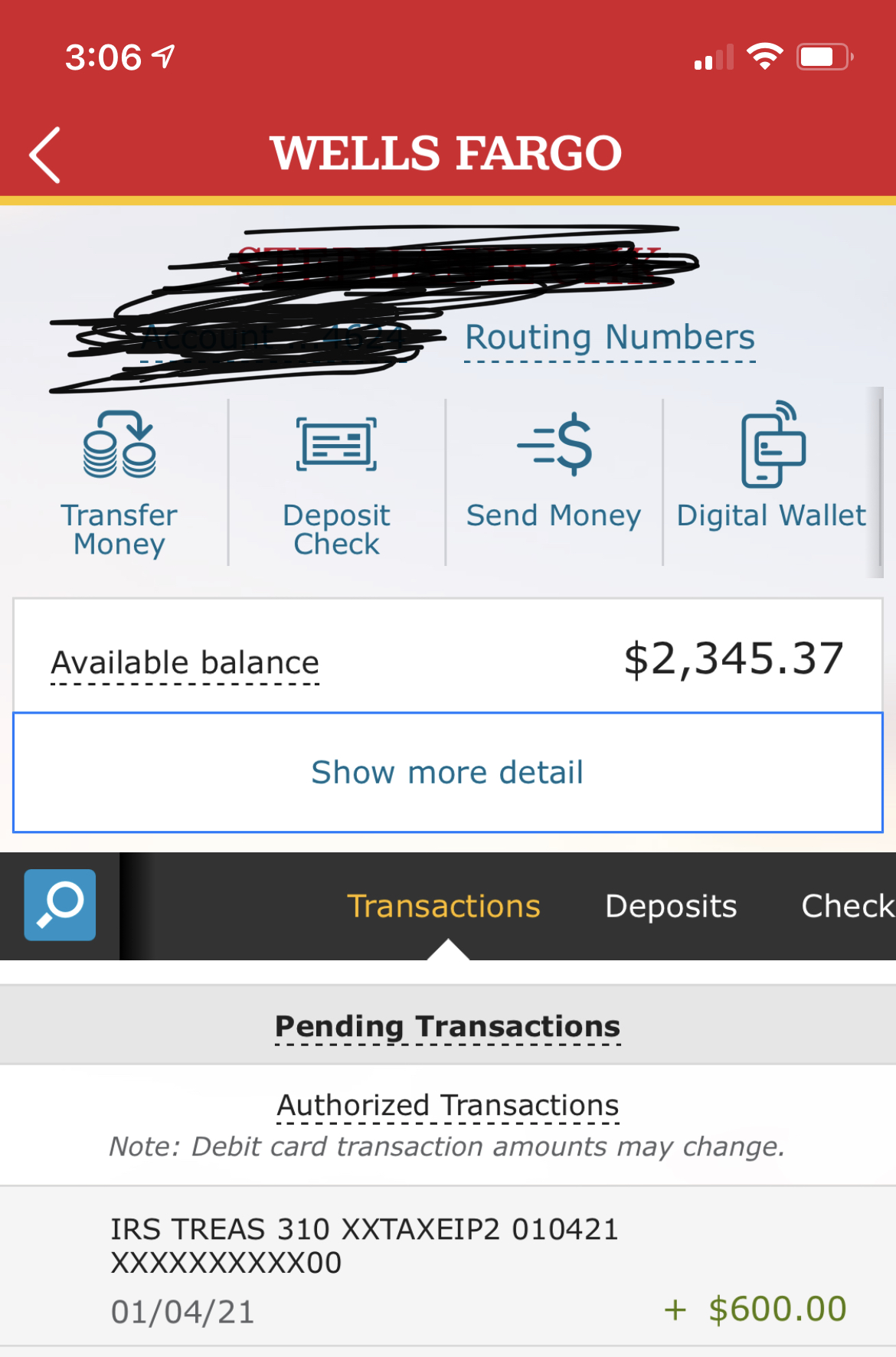

One key aspect of managing your Wells Fargo checking account is understanding the potential issues related to check usage. Overdraft fees, for example, can arise if you write a check for an amount exceeding your available balance. Similarly, exceeding any daily or monthly transaction limits on your account could lead to declined transactions or other fees. Being mindful of these potential pitfalls is essential for maintaining a healthy financial standing.

While "maximum Wells Fargo checks" isn't a fixed number, considering practical limits based on your account balance and transaction history can provide a clearer picture of your check writing capacity. This proactive approach allows you to anticipate potential issues and adjust your spending accordingly. It's about finding a balance that aligns with your financial needs and responsible account management.

One significant benefit of understanding your check writing practices is avoiding overdraft fees. For example, if you anticipate writing several large checks, confirming sufficient funds can prevent unnecessary charges. Additionally, monitoring your account activity can help you identify any unusual patterns or potential fraudulent activity.

Another advantage is the ability to plan your finances effectively. By tracking your check usage and comparing it to your account balance, you can create a realistic budget and avoid potential overspending. This allows you to allocate funds strategically and prioritize essential expenses.

A practical step towards managing your check usage is to regularly review your Wells Fargo account statements. This provides a clear overview of your transactions and helps you identify any potential issues or discrepancies. Additionally, setting up account alerts can notify you of low balances or approaching transaction limits.

Advantages and Disadvantages of Using Checks

| Advantages | Disadvantages |

|---|---|

| Tangible record of transactions | Can be lost or stolen |

| Widely accepted form of payment | Processing time can be longer than electronic payments |

| Useful for specific situations (e.g., paying rent) | Requires manual tracking and reconciliation |

One best practice is to maintain accurate records of all written checks, including the date, payee, and amount. This can simplify reconciliation and help you identify any discrepancies quickly.

Frequently Asked Questions:

1. Are there limits to how many checks I can write with Wells Fargo? (Answer: Not a specific limit, but factors like account balance and transaction limits apply.)

2. How can I avoid overdraft fees when writing checks? (Answer: Maintain sufficient funds and monitor your account balance.)

3. What should I do if I lose a checkbook? (Answer: Report it to Wells Fargo immediately.)

4. Can I track my check usage online? (Answer: Yes, through Wells Fargo online banking.)

5. What if a check I wrote is never cashed? (Answer: Contact Wells Fargo for guidance.)

6. How do I order more checks? (Answer: Through Wells Fargo online banking or a branch.)

7. Can I stop payment on a check? (Answer: Yes, through Wells Fargo online banking or by contacting customer service.)

8. Are there fees associated with writing checks? (Answer: Generally no, but overdraft fees can apply if you don't have sufficient funds.)

Tips for managing your Wells Fargo checks include: keeping accurate records, reconciling your account regularly, and setting up account alerts.

In conclusion, navigating the intricacies of Wells Fargo check usage involves understanding the interplay of several factors. While a fixed "maximum" doesn't exist, practical limitations based on your account balance and transaction history are important considerations. By adopting mindful practices like monitoring your account activity and maintaining accurate records, you can effectively manage your checking account and avoid potential issues. Empowering yourself with this knowledge contributes to a more balanced and stress-free financial life. This understanding empowers you to make informed decisions, avoid unnecessary fees, and ultimately, cultivate a healthier relationship with your finances. Take the time to review your account statements regularly, explore the resources available through Wells Fargo, and prioritize open communication with the bank to address any questions or concerns you might have. By taking proactive steps and staying informed, you can navigate the world of check writing with confidence and peace of mind.

Silence your space diy sound baffle noise reduction guide

Navigating medicare humana supplemental health can help

Unlocking hydraulic systems your guide to schematic symbols