Ever wonder how businesses keep track of their financial transactions with pinpoint accuracy? The answer lies within a structured system known as the chart of accounts, or in Spanish, "hoja de cuentas contabilidad." This foundational element of accounting provides a systematic framework for recording and categorizing every financial activity, from sales and expenses to assets and liabilities. Understanding this system is crucial for anyone involved in business, whether you're a seasoned entrepreneur or just starting out.

The chart of accounts acts as the backbone of your financial records. Imagine trying to assemble a complex puzzle without knowing where each piece fits. Similarly, without a well-defined chart of accounts structure, your financial data becomes a chaotic jumble, making it nearly impossible to gain meaningful insights. A well-organized chart of accounts, however, provides a clear and concise picture of your financial health, enabling informed decision-making and strategic planning.

The concept of systematically recording financial transactions dates back centuries, evolving alongside the practice of commerce itself. Early forms of accounting led to the development of the double-entry bookkeeping system, which forms the basis of modern accounting practices and the structure of the chart of accounts. This evolution highlights the enduring importance of having a standardized system for classifying and tracking financial information. The "hoja de cuentas contabilidad," as it's known in Spanish-speaking countries, reflects this global need for a consistent financial framework.

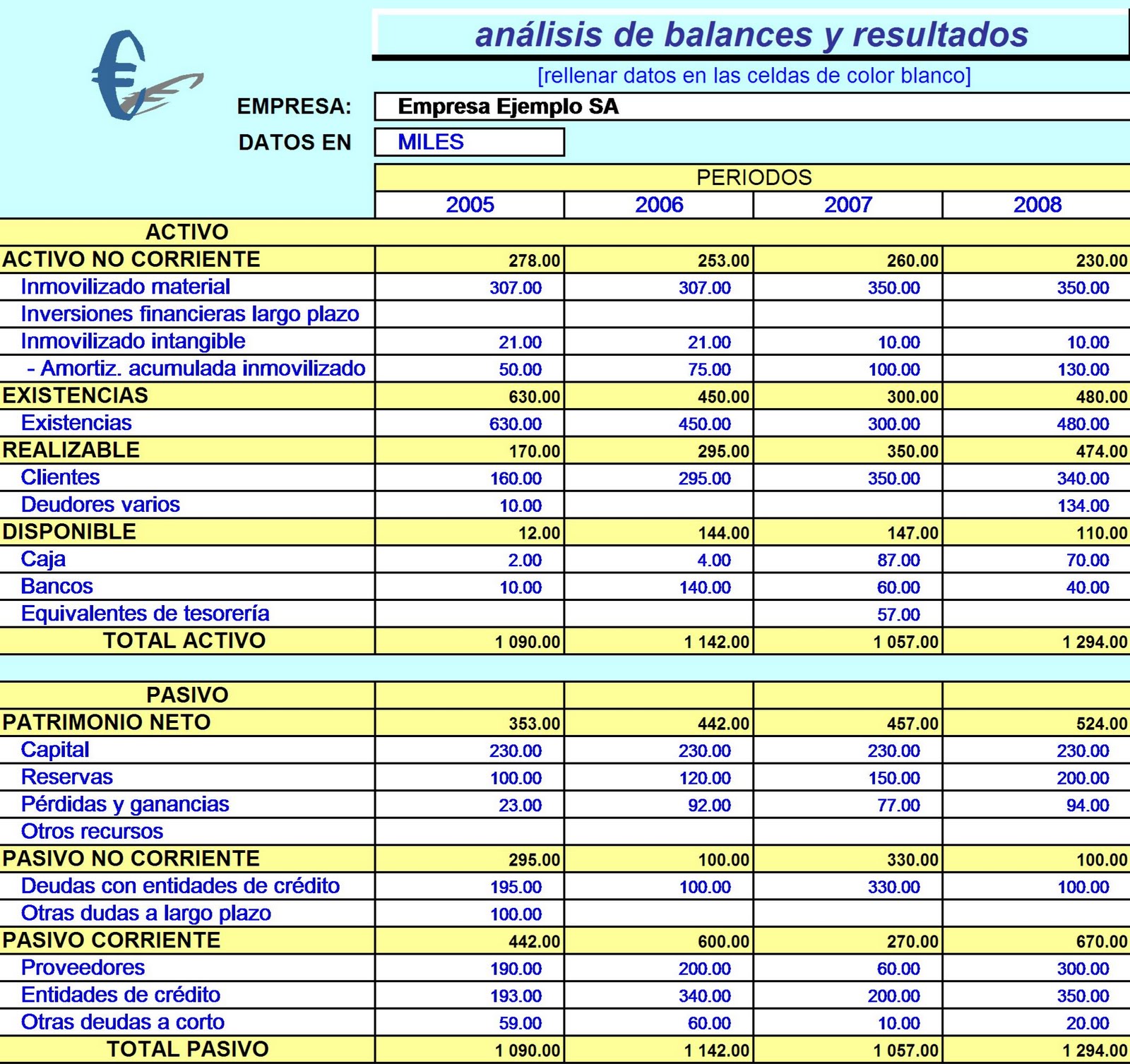

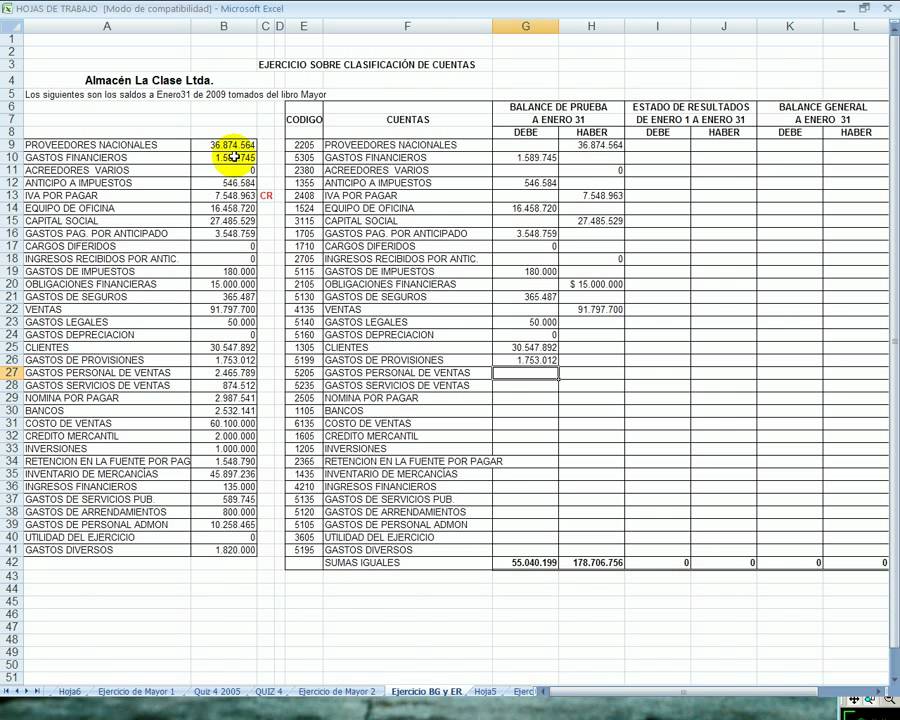

The importance of the chart of accounts, or "hoja de cuentas contabilidad," cannot be overstated. It serves as the foundation for generating crucial financial statements like the balance sheet, income statement, and cash flow statement. These statements, in turn, provide vital information about a company's financial performance, profitability, and overall health. Without a properly structured account chart ("hoja de cuentas contabilidad"), generating accurate and reliable financial reports becomes a significant challenge.

One of the main issues businesses face is creating a chart of accounts that aligns perfectly with their specific needs. A generic chart of accounts may not capture the unique nuances of a particular industry or business model. For instance, a retail business will have different account categories compared to a service-based company. Therefore, customizing the "hoja de cuentas contabilidad" to reflect the specific operational realities of the business is essential.

A chart of accounts is a structured list of all the accounts used by a business to record its financial transactions. Each account represents a specific type of asset, liability, equity, revenue, or expense. For example, "Cash," "Accounts Receivable," "Inventory," "Salaries Expense," and "Rent Expense" are all examples of accounts within a typical chart of accounts. Each account is assigned a unique number to facilitate efficient tracking and organization.

Benefits of a well-structured chart of accounts ("hoja de cuentas contabilidad") include: streamlined financial reporting, improved accuracy in financial data, and better financial analysis for strategic decision-making. For example, a well-categorized chart of accounts makes it easier to track marketing expenses and analyze their effectiveness, leading to better allocation of resources in the future.

Advantages and Disadvantages of a Detailed Chart of Accounts

| Advantages | Disadvantages |

|---|---|

| Improved Financial Reporting | Increased Complexity if Overly Detailed |

| Better Financial Analysis | Time Investment for Setup and Maintenance |

Best Practices for Implementing a Chart of Accounts ("hoja de cuentas contabilidad"): Use a consistent numbering system, tailor the chart to your specific business needs, regularly review and update the chart, ensure proper training for all users, and consult with an accounting professional for guidance.

Frequently Asked Questions:

1. What is a chart of accounts? - A list of accounts used to categorize financial transactions.

2. Why is it important? - It forms the basis for financial reporting and analysis.

3. How do I create one? - Consider your business needs and consult with an accountant.

4. How often should I update it? - Review and update it periodically as your business evolves.

5. What are some common account categories? - Assets, Liabilities, Equity, Revenue, Expenses.

6. What is the difference between a balance sheet and an income statement? - The balance sheet shows assets, liabilities, and equity at a specific point in time, while the income statement shows revenues and expenses over a period of time.

7. How does the chart of accounts relate to the "hoja de cuentas contabilidad"? - They are the same concept, with the latter being the Spanish term.

8. Can I use accounting software to manage my chart of accounts? - Yes, most accounting software packages provide tools for creating and managing chart of accounts.

In conclusion, the chart of accounts, or "hoja de cuentas contabilidad," is an indispensable tool for effective financial management. Its structured approach to recording and categorizing financial transactions empowers businesses to gain clear insights into their financial health, make informed decisions, and achieve sustainable growth. By understanding the importance of a well-designed chart of accounts and implementing best practices, you can unlock the true potential of your financial data and pave the way for long-term success. Take the time to evaluate your current system, and don't hesitate to seek professional guidance to ensure your chart of accounts is working optimally for your business. A well-structured chart of accounts is an investment in your financial future.

Elevate your gaming setup stunning ganyu genshin impact pc backgrounds

Toyota rav4 hybrid edmunds expert review and buying guide

Unraveling the jennifer flowers muck rack profile

/CuentasT-597ba12a3df78cbb7a258566.png)