Need to send money across borders? Chances are, Western Union has popped up on your radar. But what about the Western Union money exchange rate today? It's a fluctuating beast, influenced by a swirling vortex of global market forces. This deep dive will unpack everything you need to know about navigating the sometimes perplexing world of Western Union's exchange rates.

Western Union has been a key player in the money transfer game for over a century and a half. From its humble beginnings transmitting telegrams, it evolved into a global financial services giant. Today, understanding the Western Union money transfer exchange rate is crucial for anyone sending or receiving money internationally. This isn't just about knowing the cost; it's about understanding the value you're getting (or losing) in the transfer process.

The current Western Union exchange rate is a dynamic figure, constantly shifting in response to market fluctuations. Factors like currency supply and demand, geopolitical events, and even economic forecasts all play a role. Keeping your finger on the pulse of these influencing factors can help you anticipate potential rate changes and potentially save money on your transfers.

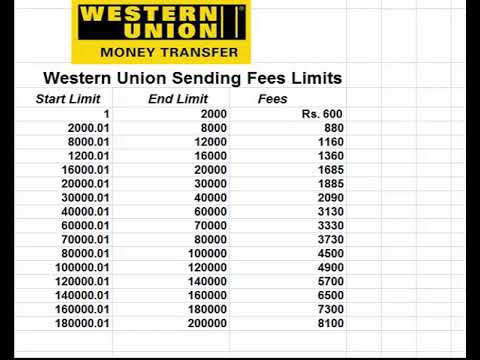

But why is understanding the Western Union currency exchange rate today so vital? Simply put, it directly impacts how much money your recipient actually receives. A seemingly small difference in the exchange rate can translate to a significant amount, especially for larger transfers. Being informed empowers you to make smarter decisions and ensure your money goes further.

One of the challenges with fluctuating rates is timing. Today's Western Union exchange rate might be different tomorrow, and significantly different next week. This volatility can make planning transfers tricky. Staying informed through Western Union's website or app, which usually provide live updates, can help you make more informed decisions about when to send your money.

Historically, Western Union has played a significant role in facilitating global commerce and personal remittances. The importance of understanding their exchange rates today stems from their continued relevance in a rapidly evolving financial landscape.

A Western Union money exchange rate, simply put, is the price of one currency in terms of another. For example, if the USD to EUR exchange rate is 0.90, it means 1 US dollar can be exchanged for 0.90 euros. This rate is influenced by supply and demand, economic indicators, and global events.

Benefits of understanding the Western Union exchange rate include: 1) Budgeting accurately: Knowing the exact cost helps you plan your finances. 2) Comparing rates: You can compare Western Union's rates with other providers to find the best deal. 3) Timing your transfers: Understanding market trends allows you to potentially transfer when rates are more favorable.

Advantages and Disadvantages of Using Western Union

| Advantages | Disadvantages |

|---|---|

| Wide global reach | Potentially higher fees compared to other services |

| Speed and convenience | Fluctuating exchange rates |

| Various transfer methods | Limited customer support in some regions |

Best Practices: 1. Compare rates: Use online tools to compare Western Union's rates with competitors. 2. Check for fees: Be aware of all fees involved. 3. Plan your transfer: Consider market fluctuations. 4. Use secure methods: Opt for official channels. 5. Track your transfer: Monitor the progress of your transfer.

FAQs: 1. How often do Western Union exchange rates change? - Frequently, sometimes multiple times a day. 2. Where can I find the current rate? - On the Western Union website or app. 3. Are there fees in addition to the exchange rate? - Yes, transaction fees may apply. 4. Can I lock in an exchange rate? - Typically, no. 5. What factors influence the rate? - Market conditions, global events, and economic indicators. 6. Is Western Union safe? - Generally, yes, but use official channels. 7. How can I track my transfer? - Through the Western Union website or app using your tracking number. 8. How can I find a Western Union agent location? - Use the agent locator on their website.

Tips: Sign up for email alerts to track rate changes. Consider transferring during off-peak hours for potentially better rates. Check for promotional offers.

In conclusion, understanding the Western Union money exchange rate today is essential for anyone sending or receiving money internationally. By staying informed about the factors influencing these rates and employing smart strategies, you can ensure your money goes further. Take the time to compare rates, research fees, and plan your transfers strategically. While the world of international finance can seem complex, taking proactive steps to understand tools like the Western Union exchange rate empowers you to make informed financial decisions and connect with loved ones or business partners across the globe. Being knowledgeable about exchange rates not only potentially saves you money but also ensures your recipients receive the expected amount. So, before you initiate your next transfer, remember to check the current Western Union exchange rate and make your money work smarter, not harder.

Unleash your inner explorer mastering the windsurf board

Phoenix rising alliance ohio a deep dive

Unlocking mr mime your guide to finding this elusive pokemon